Discover the power of RMS Manager II, the innovative risk modeling tool that can take your business to the next level.

Introduction to RMS Manager II

RMS Manager II is a powerful tool that provides advanced capabilities for risk modeling. It is designed to streamline the process of managing and analyzing data, allowing users to make more informed decisions. With its intuitive interface, users can easily create complex models, run simulations, and generate reports.

The software is built on a robust and scalable platform that can handle large amounts of data. With its advanced algorithms and modeling techniques, RMS Manager II provides accurate and reliable results. It also includes a range of features that allow users to customize their models to meet specific needs.

Whether you are working in insurance, finance, or any other industry that requires risk modeling, RMS Manager II can help you enhance your analysis and decision-making processes. With its user-friendly interface and powerful capabilities, it is the ideal tool for anyone looking to improve their risk modeling skills.

The Importance of Accurate Risk Modeling

Accurate risk modeling is crucial for any business that wants to make informed decisions based on the potential outcomes of various scenarios. This is particularly important in the insurance industry, where the ability to accurately assess risk is essential to profitability. With the increasing complexity of risks and the ever-changing regulatory environment, traditional methods of risk modeling are no longer sufficient. The use of advanced technology, such as RMS Manager II, allows for more accurate and comprehensive risk modeling that takes into account a wide range of variables. This allows businesses to make more informed decisions about pricing, underwriting, and risk management. Inaccurate risk modeling can lead to underpricing, overexposure, and ultimately financial loss. With accurate risk modeling, businesses can take proactive steps to mitigate risks and improve their bottom line. Investing in advanced technology like RMS Manager II can help businesses stay ahead of the curve and remain competitive in an increasingly complex marketplace.

Common Errors in Risk Modeling with RMS Risklink

-

Invalid Input Data:

- Check for any missing or incorrect input data.

- Verify that all required input fields are populated.

- Review input data for any formatting errors or typos.

- Ensure input data is in the correct units and format.

-

Modeling Parameters:

- Check all modeling parameters for accuracy and consistency.

- Ensure that all parameters are set appropriately for the specific model being used.

- Review any assumptions made in the modeling process.

- Verify that all parameters are up-to-date and reflect the latest industry standards.

-

Model Calibration:

- Check that the model calibration process was performed correctly.

- Verify that the calibration data used is accurate and relevant.

- Review the calibration results to ensure they are consistent with expectations.

- Make any necessary adjustments to the calibration process or data.

-

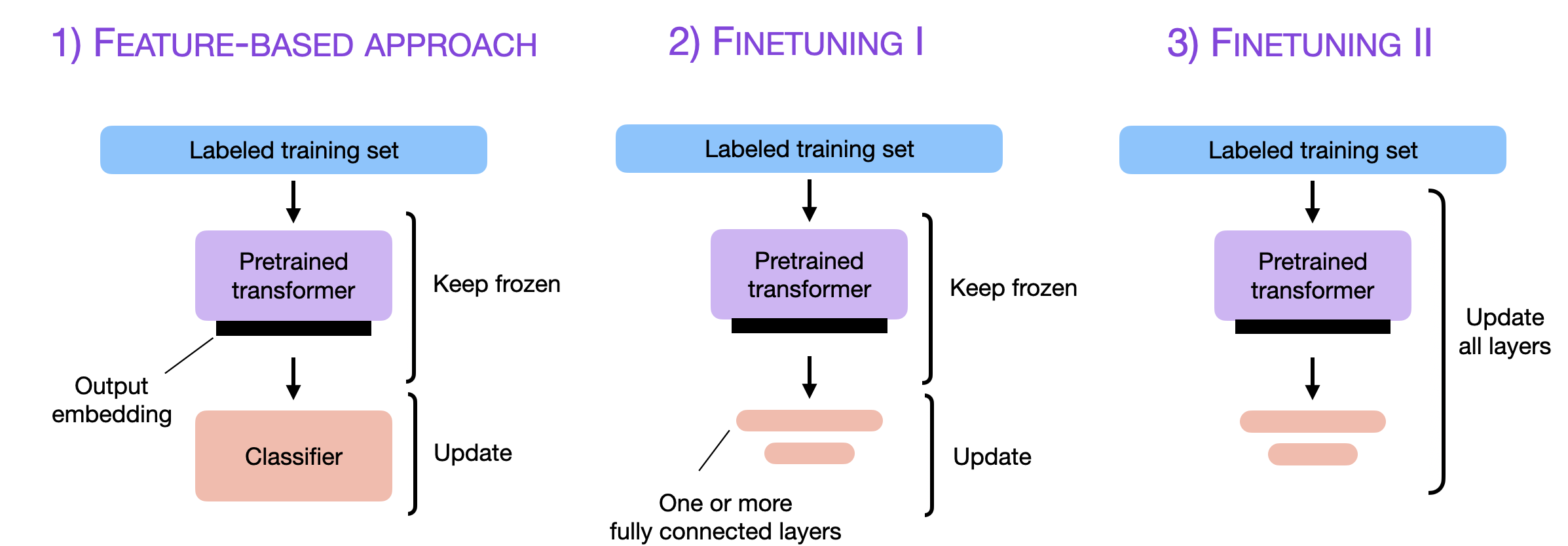

Model Validation:

- Check that the model validation process was performed correctly.

- Verify that the validation data used is accurate and relevant.

- Review the validation results to ensure they are consistent with expectations.

- Make any necessary adjustments to the validation process or data.

-

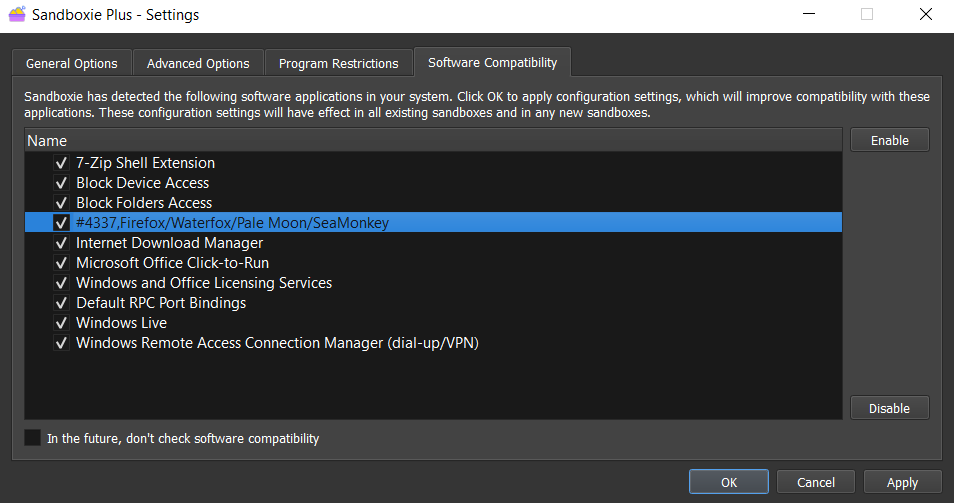

Software Configuration:

- Check that the software is configured correctly.

- Verify that all required settings are in place.

- Review the software documentation to ensure proper usage.

- Make any necessary adjustments to the software configuration.

Causes of Errors and How to Avoid Them

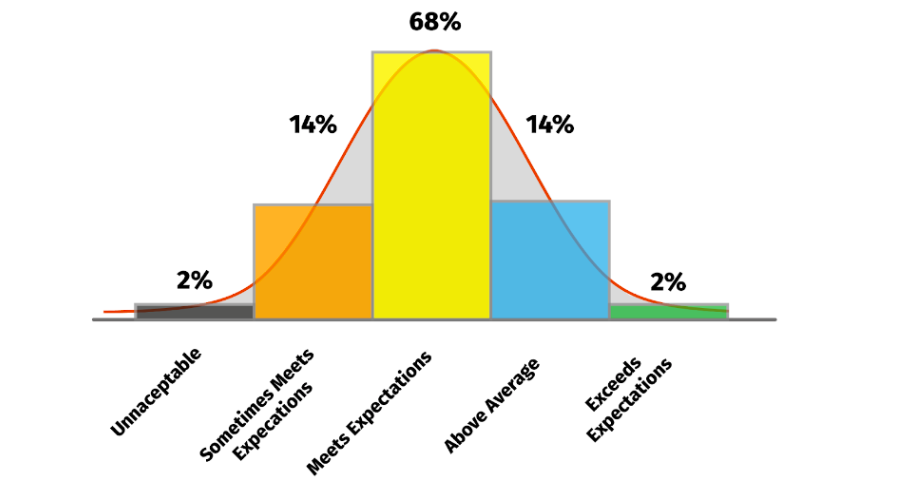

Errors in risk modeling can lead to inaccurate results and flawed decision-making. Here are some common causes of errors and tips to avoid them:

1. Inaccurate Data: Using incorrect or incomplete data can lead to inaccurate results. Make sure to verify and validate all data sources before using them.

2. Biases: Unconscious biases can affect risk modeling. Be aware of your biases and try to eliminate them from the modeling process.

3. Overfitting: Overfitting occurs when a model is too complex and fits the training data too closely. Simplify your model to avoid overfitting.

4. Lack of Transparency: Lack of transparency in the modeling process can lead to errors. Make sure to document all assumptions and decisions made during the modeling process.

To avoid these errors, use a robust risk modeling tool like RMS Manager II that can help you streamline the modeling process and ensure accuracy. With features like data validation, model tuning, and transparency, RMS Manager II can help you enhance your risk modeling and make better decisions.

Enhancing Risk Modeling with RMS Manager II Features

| Feature | Description |

|---|---|

| Advanced Analytics | Provides advanced analytics capabilities to help users identify and quantify risks more accurately and efficiently. |

| Customizable Dashboards | Allows users to create customizable dashboards to monitor and analyze key risk indicators. |

| Scenario Analysis | Enables users to conduct scenario analysis to understand the impact of different risk scenarios on their organization. |

| Data Visualization | Provides data visualization capabilities to help users better understand and communicate risk information to stakeholders. |

| Collaboration Tools | Offers collaboration tools to facilitate communication and collaboration among team members working on risk modeling. |

| Model Validation | Provides model validation capabilities to ensure the accuracy and reliability of risk models. |